The French are big savers. According to the Bank of France, the total of their main financial investments was over 5,000 billion euros at the end of 2017. The majority of this money is invested in life insurance or lying idle in a savings account. The French people thus seem to maintain a certain wariness towards financial markets. However, investing has never been easier, and markets are now accessible to everyone. Spotlight on commodities.

How to invest in commodities?

The image of the traditional stock exchange where traders shout prices out is definitively outdated. Today, everyone has access to financial markets, whether they are stocks, bonds, currency pairs, or commodities. Indeed, it is now possible to trade online simply via a mobile app that allows for investing without leaving home or calling the banker.

Most of the time, these applications offer investments in CFDs (Contracts For Difference), and the user thus benefits from leverage. The capital to invest is therefore limited.

Commodities, a hedge against inflation

The commodity market encompasses a wide variety of assets. Among the most well-known are oil, cotton, wheat, metals (gold, copper, …), as well as livestock and coffee.

Source: IG.

The greatest advantage of the commodity market is that it is known to be relatively insensitive to inflation. According to Insee, this inflation reached 1.8% in France in 2018. This is relatively high compared to previous years, and this year, a controlled but still significant inflation is expected.

The commodity market, a mirror of the global geopolitics

The major challenge of the commodity market is understanding the influence of the global political and economic context on prices. These parameters are hard to control. Nonetheless, by applying fine analysis techniques and closely following the news, one can gain an advantage. Among the major factors influencing commodity prices are conflicts and weather conditions. It should be noted that the conflict parameter also includes trade disputes. The resurgence of tensions between China and the United States, for example, obviously impacts their trade relations.

Is it a good time to invest in commodities?

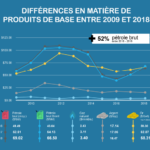

The majority of experts agree: 2018 was a difficult year for commodities, and 2019 should follow the trend. However, some also see an opportunity, as prices are at historically low levels.

Source: IG.

The Bloomberg Commodity Index (BCOM) is around 175 dollars in mid-April 2019. There could be a game to play for those willing to dedicate the necessary time. Among the most popular commodities in the markets are, of course, oil, but also steel, iron, and soybeans.

However, for beginner investors, it might be preferable to also invest in markets considered “easier,” such as the forex market. Some intermediaries also offer funds that define the investment strategy for them. The important thing will, in any case, be to evaluate the risk before venturing. Keep in mind that the Livret A savings account yields less than 1% in 2019, which is a return below the expected inflation.